Applying for your first credit card can be both exciting and stressful.

On one side of things, you’re excited about the many ways a credit card can improve your financial life.

Conversely, you have concerns about choosing the right credit card and using it in a responsible manner.

Here’s the one thing to remember: there’s no reason to rush through the process of finding and applying for a credit card. When you take your time, you’re much more likely to make an informed and confident decision that will benefit you over the long run.

Here are some key questions to answer as you ponder the idea of applying for your first credit card:

- Why do you want to carry a credit card?

- Do you have a plan for how you’ll use your credit card?

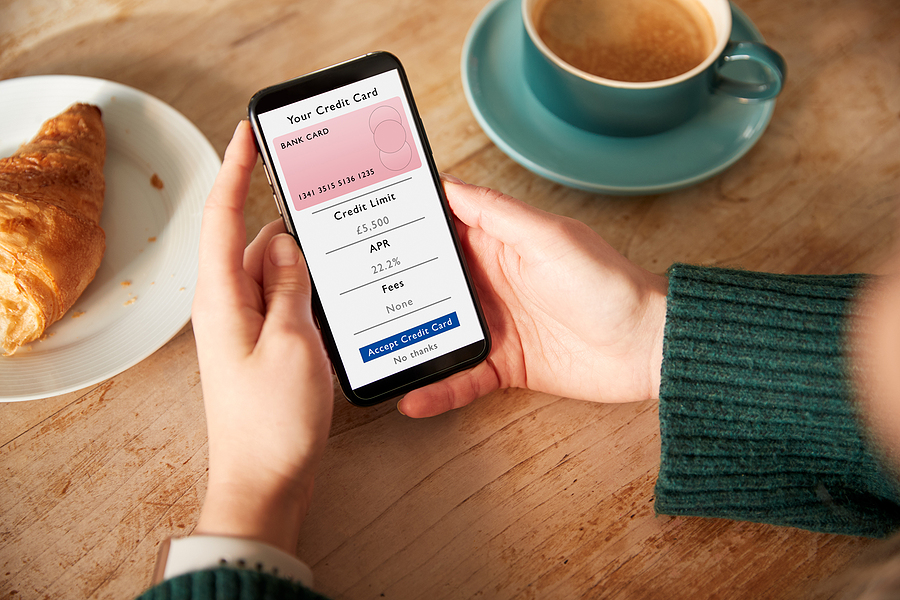

- What features are most important to you in a credit card?

- What is your credit card?

- Do you have a credit history?

- Are you interested in a rewards credit card? How about a cash back credit card?

- Are you okay with the idea of paying an annual fee?

- Are you familiar with the many fees often associated with a credit card?

- Do you know the difference between a secured and unsecured credit card?

- Have you taken the time to read online credit card reviews?

- Will you search for a credit card online or reach out to your local bank for guidance?

- Are you confident in your ability to responsibly use a credit card?

- Are you opening an account solely for yourself or will you add someone else, such as a spouse?

Yes, that’s a lot. And yes, you may have concerns about answering these questions. But take your time and see what you come up with. Even if it causes additional confusion upfront, you’ll be better for it when you make your way out the other side.

Final Thoughts

Some of these questions are easy to answer, while others will take a bit of research and thought.

Your goal is to learn as much as you can about the credit card industry and your personal finances. By doing this, you’ll soon find the best offer for you.

Are you currently searching for your first credit card? What’s most important to you? Are there any questions you’d add to the above list?

Missouri employment benefits on my chime debt card