Here’s how Grow Credit describes its service:

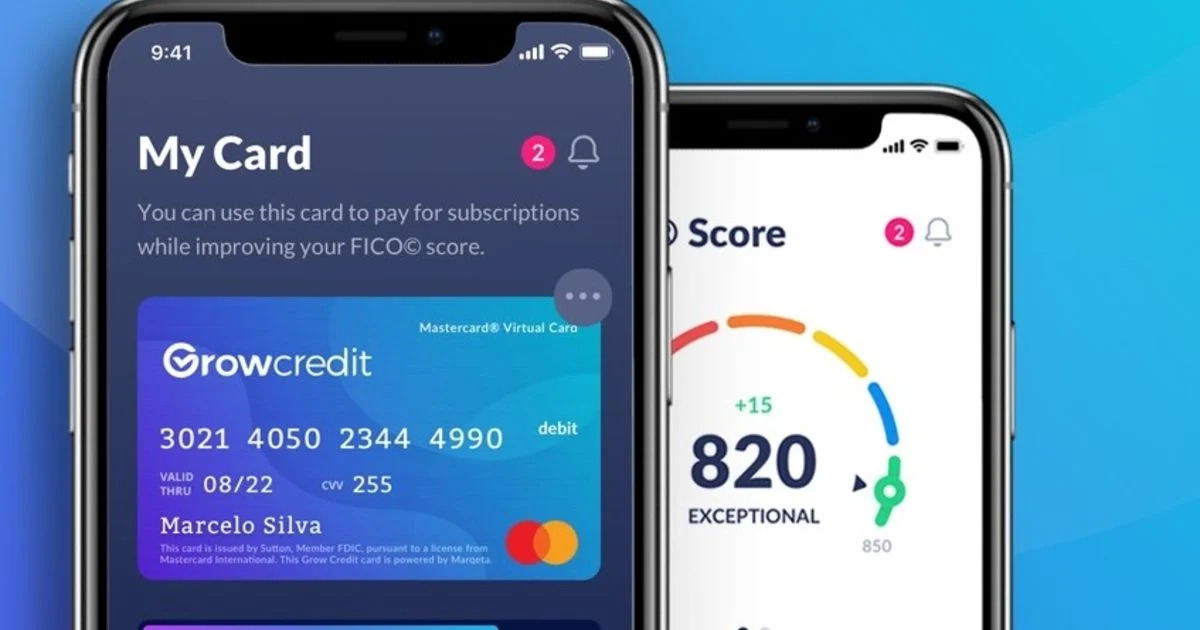

Grow Credit offers a free Mastercard you can use to pay your subscriptions and build your credit.

That’s pretty simple, right? Sign up for a free Mastercard, use it to pay for your subscriptions, and wait for your credit score to increase.

By reporting all on-time payments to the three major credit bureaus — Equifax, Experian, and Transunion — you’re taking a big step in establishing credit or boosting your current score.

Tip: Keep in mind that Grow Credit can only do so much for you. Even if you pay for your subscriptions in full and on time, it won’t do anything for your credit score if you’re maxing out your credit cards and missing loan payments.

The Four Steps to Getting Started

With four simple steps, you’ll be up and running with Grow Credit. Here’s what it takes to get started:

1. Apply for a Grow Credit Account

Apply for a Grow Credit interest-free Mastercard and link it to your bank account. It only takes a few minutes to complete an application and receive a decision.

2. Add Your Subscriptions

Grow Credit has a current list of 100+ available subscriptions, such as Pandora Radio, Netflix, and Hulu Plus. Add one or more subscriptions to your Grow Credit account.

3. Use Your Grow Credit Credit Card to Pay

Add your Grow Credit Mastercard as your payment method. From there, your accounts will be paid on time and in full every period. And when that happens, your credit score is in a position to benefit.

4. Watch Your Credit Score Grow

A Grow Credit Mastercard isn’t the only way to boost your credit score, but it’s a simple step in the right direction. Here’s a quote from a real user:

“My FICO score has jumped 20 points in a few months of using Grow, so I’m on an upward trend of credit growth and repair. Easy to set up with my current subscriptions as the virtual credit card makes it seamless.”

The Four Grow Credit Membership Levels

There are four distinct membership levels to compare and choose from:

- Build Free: Always Free – $17/month spending limit.

- Build Secured: $1.99/month – $17/month spending limit (with more features than Build Free).

- Grow Membership: $3.99/month – $50/month spending limit.

- Accelerate Membership: $7.99/month – $150/month spending limit.

As you can see, there’s a membership level for everyone. If you want to test drive Grow Credit, start with the Build Free membership to get your feet wet. Or if you’re ready to dive in head first, choose another level based on your current monthly subscription spending.

Summary

There’s never a bad time to take steps to boost your credit score. So, if you’re interested in taking a step forward, sign up for Grow Credit to manage your subscription services. It may be just what you need to build your credit from scratch or take your score to the next level.

I tried to apply, but when it got to putting my social security number in, it keeps saying it’s already in use. So if you could please check into that, it would be very helpful. I have never applied with Grow Credit before, so please help me. Thank you, in advance.