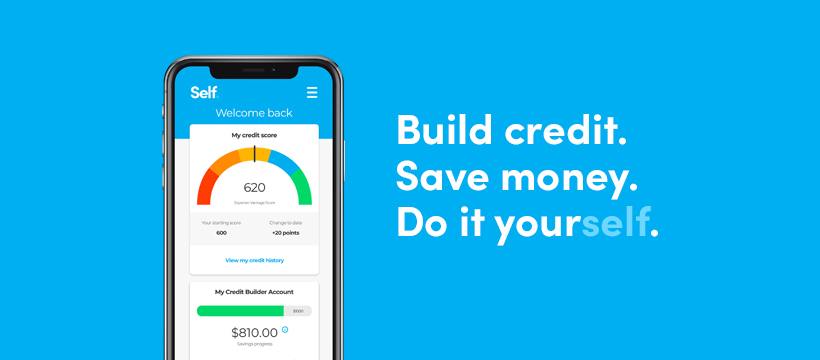

This excerpt from Self Credit Builder + Credit Card Combo website says it all:

Over 1,000,000 people have gotten their credit back on track with Self Credit Builder + Credit Card Combo.

If you’re looking to improve your credit for a better financial future, you may find that Self Credit Builder + Credit Card Combo is the tool you need by your side.

The most unique aspect of Self Credit Builder + Credit Card Combo is that you don’t start with a credit card. Instead, you build a positive payment history and then gain access to a credit card in the future. Here’s some more information on how the program works.

Use your security deposit effectively

Open a Credit Builder Account and break down your security deposit into three or more monthly payments. This is the first step in unlocking your secured credit card. Here’s what you’ll do:

- Make a minimum of three payments on time

- Have a minimum of $100 in your credit builder account

- Have an account in good standing

Use your credit card to make purchases

Use your credit card to make purchases in person and online. Doing so will help you establish credit and increase your score. As long as you use your card responsibly, the benefits will follow.

Does it really help?

At first glance, Self Credit Builder + Credit Card Combo sounds too good to be true. However, as you learn more about its structure, you’ll come to realize that it all makes sense.

Did you know that 75 percent of your credit score consists of amounts owed, credit mix, and payment history? With a Self account, you’re taking steps toward improvement in all three of these areas.

A customer review

Regardless of the product or service, there will always be satisfied and unsatisfied customers. But as you learn more about Self Credit Builder + Credit Card Combo, you’ll come to realize that there’s more positive than negative. That’s why it has an overall satisfaction rating of 4.7/5 based on 2,246 ratings from actual customers.

Here’s a customer review that provides a better idea of what you may experience:

“When I started Self Lender my credit was terrible and within the first 3 months my score increased 40 points!!!! It did take a few weeks before it reported the first time but it was well worth the wait.”

No two people have the exact same experience, but this is what Self Credit Builder + Credit Card Combo is designed to do.

Summary

Some people apply for a credit card and hope that they’ll use it in a manner that benefits their credit. Others opt for a more structured approach, and that’s what you get with Self Credit Builder + Credit Card Combo.

Apply online today. There is no credit check or hard credit pull. Once you receive an approval, you can decide if it’s the best path forward for you.